September 03, 2023

Earthmoving machinery market shows resiliance in 2023. But in 2024?

#construction site #Italy@bauma #construction & commercial vehicles #construction machinery and attachmentsThe construction equipment market is holding up and it looks like it will keep up until the end of 2023. Big uncertainty for 2024 is announced

The construction equipment market is still safe for now and the trend continue until the end of 2023.

From 2022 general economic conditions are changing for the construction machinery as well as for othe industrial sectors, but less than the forecasts released at the beginning of the year.

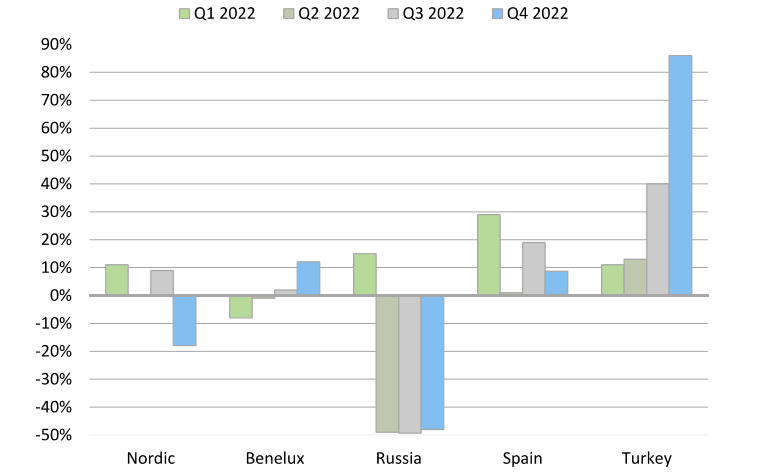

Inflation is playing a important role together with the continuous interruptions in the supply chain and the economic fallout following the war in Ukraine. For the Italian and European construction industry Russia is an important export market. The 40% drop in sales in Russia has been however largely replaced by other exchange flows, as the figures show.

Nevertheless, the resilience of the construction machinery sector continues to be the cornerstone for the entire sector.

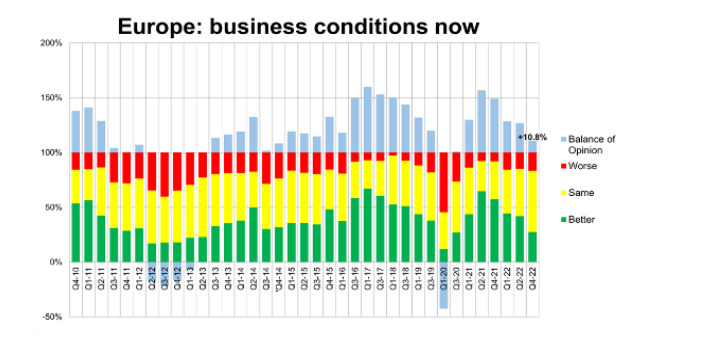

The annual economic report of CECE (Committee for European Construction Equipment) published at the beginning of the year are particularly significant.

The European Federation of Construction Machinery has traced some important trends to be kept in mind when trying to predict what will happen between now and the end of the year.

The European construction equipment market in 2022

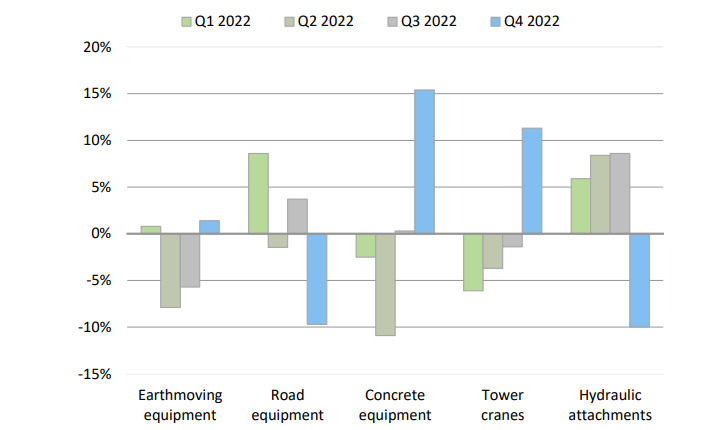

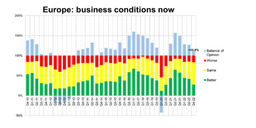

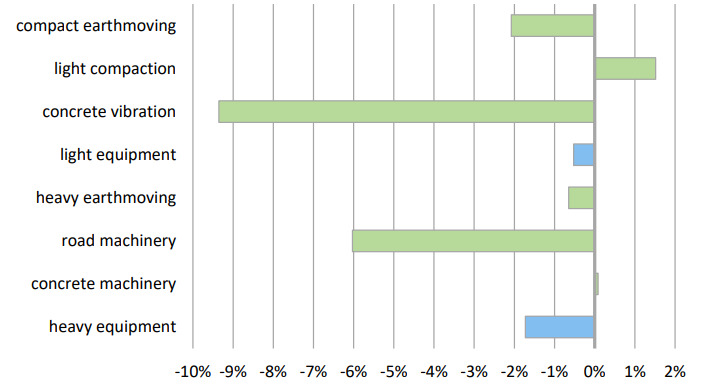

The CECE report shows that in 2022 the sales of construction equipment in Europe were practically at the same levels as in 2021 and recorded only a minimum drop of 0.6%. This confirmed the solid demand in Europe: without the continued supply chain disruptions, the market would have registered another year of growth. Sales in Europe excluding Russia - where the market fell by 37% due to Western sanctions - increased by almost 3% in 2022. Other global regions of European exports also maintained a strong pace. By the CECE Business Barometer, the end of 2022 was evaluated as positive and the confirmation of this positive trend in the first half of 2023 leads us to think that this situation will continue until the end of the year. But uncertainties about inflation and interests unfortunately predict an unstable macroeconomic framework.

Maximum caution for 2023

There have been significant changes in Europe in the last six months of 2023 that have had a major economic impact on construction: the war in Ukraine and the anxiety it has caused across the region; changes by central banks; sharp increases in interest rates in parallel with the credit crunch. Last but not least, the problems with the availability and cost of construction products with a great impact on housing, both new construction and renovation.

What will happen between now and the end of 2024?

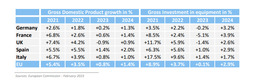

Difficult to answer this question. We are certainly experiencing a period of transition for the industry which should lead to a return to growth in 2024. According to Euroconstruct, we can expect two difficult years for the construction sector throughout Europe, with a growth forecast of just 0. 2% in 2023 and 0% in 2024.

A return to growth in production looks a little more uncertain before 2025. Construction production in the EU is expected to continue increasing until the end of 2023, but at a moderate pace.

The situation of the Italian market

Let's start from 2021. In that year, Italy was the strongest market in Europe, with production growing at 12.1%, driven in part by EU subsidies. Subsequently 2022 was an exceptional year for the construction sector with activity levels approaching the peak levels reached in 2007. The construction market benefited of significant private resources such as accumulated savings by households and businesses in both 2020 and 2021.

Alongside this, the huge public resources (tax incentives such as the Superbonus as well as the national fund recovery plan) have supported the activity. However, a trend reversal is expected in 2023.

In addition to the surge in prices within the sector, construction will cost between 15 and 20% more than in 2019 and inflation has also started to affect housing prices and demand. 2023 is therefore shaping up to be a year of transition, marked by a general slowdown but overall production growth is expected to remain positive at 0.9%. This will lead to an uneven situation among the various sectors which will go from -9% for the residential sector for maintenance works to +41.7% for new public works.

From 2024 the market is expected to slow down significantly. Total investment is expected to decline by 7.1% and residential renovations and maintenance are expected to decline by 22.6%. Incentive programs have been the main driver for construction work but are set to be scaled back. Expectations for public works are different, but to date a question mark remains on the realization of the works subsidized by the National Plan, and on the ability of administrations and businesses to meet the objectives expected by the European Union.

The challenges concern not only the design and execution of the works but also the procurement and cost of materials.

The construction machinery market in Europe and worldwide

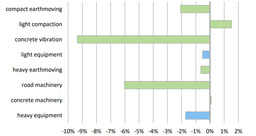

The resilience of the construction equipment sector is well established and has always been supported by a stable business situation in most sectors, but it is still surrounded by a toxic mix of inflation, constant supply chain disruptions, and worries about the world economy.

At the beginning of 2023, the majority of companies report a positive business situation and have positive expectations for the near-term future. In the February survey, construction equipment manufacturers were once again the most optimistic group. When looking at business expectations by region, manufacturers view North America and, to a lesser extent, Latin America as the best prospects. In Europe, ambitions focus on Germany, France and CEE markets as the best opportunities. The perception of the Russian market, which is still at the bottom of the list in terms of market expectations, is taken for granted. The industry's backlogs have reduced in part due to greater willingness to build and deliver machines. However 60% of European producers still report a backlog of more than four months. This confirms that at least the first half of 2023 has been safe

while the second half of the year could lead to a more challenging scenario. Higher interest rates due to current inflation in Europe have a significant impact on the outlook for the construction industry, especially the residential sector, and this may affect sales of equipment that is used in this sector as well as the gardening and landscaping sector which will likely see weaker demand after many years of booming sales. Civil engineering however will still benefit from public investment programs in many European countries. Assuming that the geopolitical scenario will not change this year, the European market is expected to record a single-digit decline in sales.

But that doesn't necessarily mean that European manufacturers will face a loss of revenue, also because markets – particularly in North America, Latin America and the Middle East – remain positive.